George Carlin Talks About Big Banks Who Own Everthing And Talks About How You Are A Slave.

World Banker Makes Stunning Confession

The Video Everyone Needs To See, But For Different Reasons… The Former President Of The World Bank, James Wolfensohn, Makes Stunning Confessions As He Addresses Graduate Students At Stanford University.

He Reveals The Inside Hand Of World Domination From Past, To The Present And Into The Future. The Speech Was Mas Made January 11Th, 2010. The Next 19 Minutes May Open Your Mind To A Very Deliberate World.

He Tells The Grad Students What’s Coming, A “Tectonic Shift” In Wealth From The West To The East. But He Doesn’t Tell The Students That It Is His Institution, The World Bank, That’s Directing And Channeling These Changes.

Wolfensohn’s Own Investment Firm Is In China, Poised To Profit From This “Imminent Shift” In Global Wealth.

European debt crisis spiralling out of control

Reports that Germany and France have begun talks to break up the eurozone amid fears that Italy will be too big to rescue

Fears that Europe’s sovereign debt crisis was spiralling out of control have intensified as political chaos in Athens and Rome, and looming recession, created panic on world markets.

Reports emerging from Brussels said that Germany and France had begun preliminary talks on a break-up of the eurozone, amid fears that Italy would be too big to rescue.

Despite Silvio Berlusconi’s announcement that he would step down as prime minister once austerity measures were pushed through parliament, a collapse of investor confidence in the eurozone’s third-biggest economy sent interest rates in Italy to the levels that triggered bailouts in Portugal, Greece and Ireland.

Italian bond yields surged through the critical 7% mark, at one point hitting 7.5%, amid concern that the deteriorating situation had moved the crisis into a dangerous new phase.

In Athens talks to appoint a prime minister to succeed George Papandreou were in deadlock, and will resume on Thursday morning. The Italian president, Giorgio Napolitano, sought to reassure the markets by promising that Berlusconi would be leaving office soon.

Angela Merkel, the German chancellor, said the situation had become “unpleasant”, and called for eurozone members to accelerate plans for closer political integration. “It is time for a breakthrough to a new Europe,” she said. “Because the world is changing so much, we must be prepared to answer the challenges. That will mean more Europe, not less Europe.”

The president of the European commission, José Manuel Barroso, issued a new call for the EU to “unite or face irrelevance” in the face of the mounting economic crisis in Italy. “We are witnessing fundamental changes to the economic and geopolitical order that have convinced me that Europe needs to advance now together or risk fragmentation. Europe must either transform itself or it will decline. We are in a defining moment where we either unite or face irrelevance,” he said.

Senior policymakers in Paris, Berlin and Brussels are reported to have discussed the possibility of one or more countries leaving the eurozone, while the remaining core pushes on toward deeper economic integration, including on tax and fiscal policy. “France and Germany have had intense consultations on this issue over the last months, at all levels,” a senior EU official in Brussels told Reuters, speaking on condition of anonymity because of the sensitivity of the discussions.

Financial regulators across Europe were last night carefully monitoring the health of their heavily exposed banks, amid concern that the turmoil could lead to a debt default, or even the break-up of the euro.

George Osborne, just three weeks away from delivering his autumn statement on the health of the economy, believes Europe’s problems are blighting the UK’s growth prospects, but he will use the sell-off of Italian bonds to insist there is no alternative to his austerity plans.

Nick Clegg, the deputy prime minister, spent Wednesday in Brussels urging the council president, Herman Van Rompuy, and a clutch of EU commissioners to focus on growth, and not further treaty changes, warning that if Europe does not become more competitive it will end up in a spiral of perpetual decline. Both he and David Cameron are urging EU integrationists to recognise that EU Treaty changes in the next few months would be a massive distraction and no cure for the underlying economic crisis. He pointed out that they would require referendums in at least four countries.

The latest chapter in the ongoing sovereign debt crisis came as Bank of England policymakers gathered for their monthly two-day interest rate-setting meeting. The monetary policy committee announced £75bn-worth of quantitative easing last month in an effort to prevent a recession.

City analysts believe the renewed turmoil in the eurozone is pointing to a deep recession in Europe. “It’s unavoidable that there will be an outright contraction in the fourth quarter of this year, and a 60%-70% chance of another decline in the first quarter of next year,” said Nick Parsons, head of strategy at National Australia Bank.

Shares fell heavily on both sides of the Atlantic. The Italian stock market lost 4% of its value. The FTSE100 index of leading shares closed 106.96 points down, at 5460.38. The Dow Jones closed 389 points down at 11,780.94.

Christine Lagarde, head of the IMF, told a financial forum in Beijing that Europe’s debt crisis risked plunging the global economy into a Japan-style “lost decade” of weak growth and deflation.

“Our sense is that if we do not act boldly and if we do not act together, the economy around the world runs the risk of a downward spiral of uncertainty, financial instability and potential collapse of global demand … we could run the risk of what some commentators are already calling the lost decade.”

Simon Derrick, currency strategist at BNY Mellon, said: “We’re at the point of asking the question, if I put my money into Italy, am I going to get it back? The fact is, there isn’t a safety net.” He added that the mood in the City was reminiscent of Black Wednesday, in September 1992, when the UK crashed out of the European Exchange Rate Mechanism.

The surge in Italian bond yields was eventually capped by the European Central Bank, which intervened in the markets to buy limited quantities of Italian debt. But analysts say the ECB will eventually have to step up its action, and act as a lender of last resort to bring interest rates down to pre-crisis levels. Sony Kapoor, director of Brussels-based think-tank Re-Define, said: “We may be fairly close to the point where an existential threat to the eurozone, and hence the ECB, is on the horizon. This could easily spiral out of control.”

The ECB is seen as the only institution with the firepower to rescue Italy, because the EU lacks the resources to bail out such a large economy. Ben May, of Capital Economics, said Italy would need a €650bn bailout to keep it out of financial markets for the next three years or so. “The European Financial Stability Facility will not be able to provide a bailout of this size,” he said.

Officials in Brussels insisted on Wednesday there would be no rescue package for Rome, saying, “financial assistance is not on the cards”. A key test will come on Thursday morning when Italy has to raise €5bn from investors on the bond market.

Economic and monetary affairs commissioner Olli Rehn ratcheted up the political pressure on Italy with a strongly-worded letter to finance minister Giulio Tremonti. In it, Rehn demanded concrete written details of how Italy will implement each of the 39 separate reform measures it has promised to undertake.

In Rome the head of state, Giorgio Napolitano, insisted that Berlusconi would be leaving office soon, and that his departure would not be the prelude to a lengthy period of political instability.

His intervention came after hurried consultations with the speakers of both houses of parliament to ensure the speediest possible approval for a package of economic reform and austerity measures agreed with the European institutions. On Tuesday evening, after losing his majority in the chamber of deputies, Berlusconi told Napolitano he would resign.

But, to prevent the economic measures being blocked by the fall of his government, he said he would only go once the package had been approved.

As concern grew that he might delay the passage of the legislation, which has become a litmus test of Italy’s credibility in the markets, Berlusconi said he would insist on holding new elections and one of his ministers speculated that could be next February.

After the yield on Italy’s benchmark bonds soared above 7%, taking interest rates to a level beyond which previous euro zone debt crisis victims have sought a bail-out, the president issued a statement to say the new economic measures would be “approved in the space of a few days” and that there was “no uncertainty over the prime minister’s decision to resign”.

Napolitano, who cannot begin consultations with party leaders until Berlusconi leaves office, said that either a new government would be formed “to take every necessary decision” or an election would be held “within the shortest time”.

That would still mean a vote was not held until January. But a source close to the president stressed to the Guardian that “early elections are not a foregone conclusion.”

Source:

https://www.guardian.co.uk/business/2011/nov/09/european-debt-crisis-eurozone-breakup

Gerald Celente: We’re Going Into An Economic 9/11

The new job numbers are out for the month of November. The Labor Department announced that unemployment is declining and was 8.6 percent for last month.

Roughly 120 thousand private jobs were created in the month of November, but critics say retail and hospitality jobs aren’t the type of jobs America needs.

Others say that this doesn’t make up for the new people joining the workforce.

Gerald Celente, publisher of The Trends Journal, sounds off on the issue.

International Bribery Scandal Invades The ECB

The bribery scandal came at the worst possible moment for the European Central Bank. Already it’s struggling on a daily basis with the ballooning debt crisis in the Eurozone. And it’s trying to defend its independence against an onslaught of demands to print unlimited amounts of euros and buy the crappy sovereign bonds of the Eurozone’s weaker members. But now, Ewald Nowotny, member of its Governing Council, is up to his neck in hot water.

A spokesperson of the state prosecutor in Vienna, Austria, announced on Monday that the criminal investigation of an international bribery scandal that has been simmering for a while has been expanded to over 20 suspects. And it has now entangled six current directors of the Austrian National Bank (OeNB), including its Governor, Ewald Nowotny (Handelsblatt).

The scandal is centered on a division of the OeNB, the Oesterreichische Banknoten- und Sicherheitsdruck GmbH, (OeBS), which is in the lucrative business of printing money, literally. And it has been active in soliciting bank-note business from foreign governments since 2000. On its website, it claims that it “excels at combining innovative security features with modern designs.” Apparently, it also excels at bribery, kickbacks, and money laundering.

According to the prosecution, OeBS paid €17 million in bribes to Syrian officials to obtain orders from the Syrian government (Wiener Zeitung). Payments were routed to offshore outfits, such as the Panamanian mailbox company Venkoy, with representatives in Switzerland. The prosecutor is further investigating €1.7 million in kickbacks that made their way back to Austria (Die Presse). Similar arrangements with Azerbaijan are also being investigated. Two weeks ago, four people—the managing director and the head of marketing of OeBS and two lawyers—were arrested. Bits and pieces of the affair began to see the light of the day last June, when questions were raised by Austrian tax authorities about the deductibility of these payments.

The OeNB confirmed on Monday that a criminal prosecution has been initiated against six of its directors, including its Governor Ewald Nowotny, Vice Governor Wolfgang Duchatczek, and Director Peter Zöllner, who were accused of having known about the bribery of foreign public officials in connection with the acquisition of bank note printing orders. Of course, it defended its directors: the accusations were based on statements by fired employees, it said—implying that it’s nothing but a vendetta. Based on the information the directors had in front of them at the time, they’d assumed that the payments were for actual and legitimate services, and that the acquisition of orders complied with all applicable rules and laws, it said.

But on November 9, the Vienna-based daily paper Kurier created a stir when it said that it had obtained a copy of the minutes of the OeNB Board of Directors meetings. According to these minutes, the directors had known for years that millions of euros in bribes were being paid to acquire bank-note business from foreign governments.

For example, on March 24, 2010, the managing director of OeBS informed the OeNB board about a possible order from Azerbaijan for 150 million bank notes that carried a “commission” of 10%. And how did the board react? “Duchatczek asked the managing director to initiate the acquisition activities so that the years 2011 and 2012 would be at capacity.”

Over the years, the minutes show, Nowotny, Duchatczek, and their colleagues asked questions about various payments but then did nothing. For example, on December 15, 2008, Nowotny asked about the amount of a commission and the recipient in Azerbaijan. The managing director then “informed that there is a representative in Switzerland,” and that the commission would amount to 20% of the order. And that was that.

The OeNB had already tried to stamp out the brushfire and protect its directors by firing the managing director and the director of marketing at the OeBS. Stated reason? An internal audit revealed “unlawful actions and withholding of information from the Supervisory Board.” At the time, the bribery of Syrian officials had already surfaced, along with €600,000 in “unusual expenses.”

Maximum penalty for bribery is ten years in prison, according to the Handelsblatt. But given the impunity with which central bankers act, I doubt that Nowotny or the other central bankers will ever face any serious risk of ending up there. He might not even lose his jobs at the OeNB and at the ECB. And his future, well, given that he is a central banker, looks bright.

Proton Bank in Greece had siphoned off $1 billion in a scheme of fraud, embezzlement, money laundering, and offshore front companies. And got bailed out. But then a bomb exploded…. European Bailout Fund Pays For Greek Money Laundering And Fraud.

TCF Bank Penalizes Kid With $4.85 In His Account By Charging Him $234.95 In Fees In Two Weeks

A young man left $4.85 in his TCF Bank account. TCF assessed him a $9.95 “maintenance fee” for not having enough money in his account. Then they charged him for being overdrawn by $5.10 (ten cents more than he was allowed by their rules).

In less than two weeks, they’d assessed so many fees and penalties against the account holder that he owed them $229.10. All for having the temerity to have a low-balance account. The bank said it was his own fault for not having more money. Finally, they relented — only after being contacted by a newspaper.

“I try to raise my children the right way and if my son would have overdrawn this account because of spending money he didn’t have we would have made him take care of it,” she said. “But what TCF did is not right. Money is tight right now and if this is their way of making money, they need to be stopped.”

Ganziano said the entire goal of setting up the account was to teach her sons how to be smart with their money.

“When they get zapped this way, why would they trust a bank?” she said.

Bank fees that overdraw teen’s account have mom seeing red

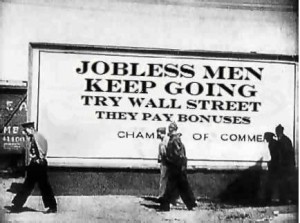

Destroying Empires 101

Every military strategist and war time general knows never to attack an empire head on. You destroy it from the inside out. You cut off supply lines (sanctions), cause civil unrest or civil war by funding both sides (Sunni and Shiite in Iraq), and instill economic destruction and slavery with usery (interest on top of interest to make freedom from debt impossible).

This financial situation we are in is no accident. How can it be? With the supposed best and the brightest Harvard and Yale educated minds making life changing decisions on our behalf, how can they be wrong so often? How can they be so ignorant or naive as not to learn from the past? How can the state of our country and many others around the world be an “accident”? The answer of course is, it can’t be.

If you overspend and have problems paying your bills during a particular month and one of those bills goes into collections, do you do the same thing next month? No, you make sure you don’t repeat that same mistake. Guess what? There is a really good chance you never even went to Harvard or Yale, and you figured that out all by yourself. Imagine that?

Obama’s brilliant answer to this problem was to put the very bankers that caused this situation in charge of the banking industry and to impose (I’m trying not to laugh as I type this) “unprecedented regulatory reform” over Wall Street.

Roosevelt did almost the exact same thing after Hoover left office as to “ensure nothing like this would ever happen again”. But yet here we are “again” albeit with one great difference. That difference is the peoples’ ability to be self sufficient. In the late 20′s and 30′s, people had the ability to farm, to manufacture useful items with their hands, to barter. Their dollars were backed in gold. That was until 1934 when the government ordered all citizens to surrender their gold in the name of “stabilizing markets“. Coincidentally, gold spiked $15 per oz. after the confiscation. Nice profit, too bad it wasn’t in the hands of the people. Most people posses none of those skills, so what will they do?

I understand that its hard to accept the idea of our current situation as being one of intent, but it’s time we do. The sooner we come to this realization, and accept it, the easier it will be to deal with what’s coming.

Corzine Can’t Explain Missing MF Global Funds

WASHINGTON (AFP) - Former Wall Street high-flyer and Democratic politician Jon Corzine told US lawmakers Thursday he did not know what happened to an estimated $1.2 billion that disappeared from the accounts of now bankrupt broker MF Global.

Corzine — former US senator, New Jersey governor, head of Goldman Sachs and later MF Global — apologized to investors and claimed he could account for the loss of “many hundreds of millions of dollars.”

“I simply do not know where the money is, or why the accounts have not been reconciled to date,” he told lawmakers, as he faced the glare of TV cameras for the first time since the firm went bust.

MF Global collapsed in October after making vast bets on European sovereign debt — particularly Belgium, Italy, Spain, Ireland and Portugal — that turned sour amid the eurozone financial crisis.

Around $1.2 billion appears to be missing from the customer accounts of failed US broker, which especially served investors in commodity futures and derivatives, a liquidator of the company has said.

In contrite testimony, Corzine described for the House of Representatives Agriculture Committee in broad strokes his tenure at the head of the company and the events leading up to bankruptcy.

“I appear at today’s hearing with great sadness,” said Corzine, clad in a deep blue grey suit and tie, speaking softly and shifting in his seat as he began his testimony.

“My sadness, of course, pales in comparison to the losses and hardships that customers, employees and investors have suffered as a result of MF Global’s bankruptcy.”

The committee’s Republican chairman Frank Lucas said stressed the impact of the firm’s failure on farmers and agricultural businesses that used MF to hedge for shifts in commodity prices.

“Thousands of your former customers across the country are experiencing severe financial hardship because of events that occurred under your watch,” he told Corzine.

The former CEO acknowledged he had strongly advocated MF’s investment of its own money in eurozone debt, but insisted he knew nothing about the missing funds the day before its formal bankruptcy.

“Many transactions occurred in those last chaotic days.”

“(I) believed that (MF Global’s) investments in short-term European debt securities were prudent,” he said.

With Republicans sharpening the knives for regulators appointed by President Barack Obama, Corzine was at pains to stress his limited contact with the head of the Securities and Exchange Commission Mary Schapiro and the head of the Commodity Futures Trading Commission Gary Gensler.

In one telling exchange Democrat Collin Peterson said he did not know how address the former CEO, lawmaker and governor.

“Many people have bad names,” Corzine interjected.

Source: https://www.activistpost.com/2011/12/corzine-cant-explain-missing-mf-global.html

The Fed’s $29 Trillion Bail-out of Wall Street

By L. Randall Wray on December 9th, 2011

Since the global financial crisis began in 2007, Chairman Bernanke has striven to save Wall Street’s biggest banks while concealing his actions from Congress by a thick veil of secrecy. It literally took an act of Congress plus a Freedom of Information Act lawsuit by Bloomberg to get him to finally release much of the information surrounding the Fed’s actions. Since that release, there have been several reports that tallied up the Fed’s largess. Most recently, Bloomberg provided an in-depth analysis of Fed lending to the biggest banks, reporting a sum of $7.77 trillion. On December 8, Bernanke struck back with a highly misleading and factually incorrect memo countering Bloomberg’s report. Bloomberg has—to my mind—completely vindicated its analysis; see here: https://www.bloomberg.com/news/2011-12-06/bloomberg-news-responds-to-bernanke-criticism.html.

Any fair-minded reader would conclude that Bernanke’s memo to Senators Johnson and Shelby and Representatives Bachus and Frank is misleading. One could even conclude that it is not just a veil of secrecy, but rather a fog of deceit that the Fed is trying to throw over Congress.

He argues that the sum total of the Fed’s lending was a mere $1.2 trillion, and that it was spread across financial and nonfinancial institutions of all sizes. Further, he asserts that the Fed never tried to hide the bail-outs from Congress. Both of these assertions fly in the  face of the facts available (as the Bloomberg response makes clear).

face of the facts available (as the Bloomberg response makes clear).

As Bernanke notes, highly credible analyses of the bail-out variously put the total at $7.77 trillion (Bloomberg) to $16 trillion (GAO) or even $24 trillion (I think this is Senator Bernie Sanders’ figure). He argues that these reports make “egregious errors”, in particular because they sum lending over-time. He also claims that these high figures likely include Fed facilities that were never utilized. Finally, he asserts that the Fed’s bail-out bears no relation to government spending, such as that undertaken by Treasury.

All of these assertions are at best misleading. If he really believes the last claim, then he apparently does not understand the true risks to which he exposed the Treasury as the Fed made the commitments.

There are a number of issues that must be understood. First, the Fed quibbles about the differences among lending, guarantees, and spending. For the purposes of this blog I will accept these differences and call the sum across the three “commitments”. In spite of what Bernanke claims, these do commit “Uncle Sam” since Fed losses will be absorbed by the Treasury. (The Fed pays profits to Treasury, so if its profits are hurt by losses, payments to Treasury are reduced. If the Fed should go insolvent, the Treasury will almost certainly be forced to recapitalize it.) I do, however, agree with the Chairman that a tally should not include facilities that were created but not utilized (there were several of them, and the tally I present below does not include any facilities that were not used).

Second, there are (at least) three different ways to measure the Fed’s bail-out. One way would be to find the day on which the maximum outstanding Fed commitments was reached. According to the Fed, that appears to have been about $1.5 trillion sometime in December 2008. I’m willing to take Bernanke at his word. Another way would be to take the total of commitments made over a short period of time—say, a week or a month. That would be a measure of systemic distress and would help to identify the worst periods of the GFC (global financial crisis). Obviously, this will be a bigger number and will depend on the rate of turn-over of Fed loans. For example, many of the loans were very short-term but were renewed. Bernanke argues that it is misleading to add up across revolving loans. Let us say that a bank borrows $1 million over night each day for a week. The total would be $7 million for the week. In a period of particular distress, the peak weekly or monthly lending would spike as many institutions would be forced to continually borrow from the Fed. Bernanke argues we should look only at the lending at a peak instant of time.

Think about it this way. A half dozen drunken sailors are at the bar, and the bartender refills their shot glasses with whiskey each time a drink is taken. At any instant, the bar-keep has committed only six ounces of booze. That is a useful measure of whiskey outstanding. But it is not useful for telling us how much the drunks drank. Bernanke would like us to believe that if the Fed newly lent a trillion bucks every day for 3 years to all our drunken bankers that we should total that as only a trillion greenbacks committed. Yes, that provides some useful information but it does not really measure the necessary intervention by the Fed into financial markets to save Wall Street.

And that leads to the final way to measure the Fed’s commitments to propping up our drunks on Wall Street: add up every single damned loan, guarantee and asset purchase the Fed made to benefit banks, banksters, real Housewives on Wall Street, fraudsters, and their cousins, aunts and uncles. This gives us the cumulative Fed commitments.

The final important consideration is to separate “normal” Fed actions from the “extraordinary” or “emergency” interventions undertaken because of the crisis. That is easier than it sounds. After the crisis began, the Fed created a large alphabet soup of special facilities designed to deal with the crisis. We can thus take each facility and calculate the three measures of the Fed’s commitments for each, then sum up for all the special facilities.

And that is precisely what Nicola Matthews and James Felkerson have done. They are PhD students at the University of Missouri-Kansas City, working on a Ford Foundation grant under my direction, titled “A Research And Policy Dialogue Project On Improving Governance Of The Government Safety Net In Financial Crisis”. To my knowledge it is the most complete and accurate accounting of the Fed’s bail-out. Their results will be reported in a series of Working Papers at the Levy Economics Institute (www.levy.org). The first one will be posted soon, and is titled$29,000,000,000,000: A Detailed Look at the Fed’s Bail-out by Funding Facility and Recipient. Watch for it!

Here’s the shocker. The Fed’s bail-out was not $1.2 trillion, $7.77 trillion, $16 trillion, or even $24 trillion. It was $29 trillion. That is, of course, the cumulative total. But even the peak outstanding numbers are bigger than previously reported. I do not want to take any of their fire away—interested readers must read the full account. However, I will use their study as the source for a brief summary of total Fed commitments.

Here I am only going to focus on the final measure of the size of the bail-out: the cumulative total. This is not directly comparable to the Fed’s $1.2 trillion estimate, which is peak lending. It is closest to the $24 trillion figure that I believe Senator Sanders is using. The difference from that number is probably attributable to choice of facilities to include.

I will post more on the important research done as part of this Ford Foundation grant; in coming blogs I will also explain why all Americans should be horrified at the Fed’s actions, and by Bernanke’s continued attempt to cover-up what the Fed has done.

Summary of Total Cumulative Fed Commitments

When all individual transactions are summed across all facilities created to deal with the crisis, the Fed committed a total of $29,616.4 billion dollars. This includes direct lending plus asset purchases. Table 1 depicts the cumulative amounts for all facilities; any amount outstanding as of November 10, 2011 is in parentheses below the total in Table 1. Three facilities—CBLS, PDCF, and TAF—overshadow all other facilities, and make up 71.1 percent ($22,826.8 billion) of all assistance.

Table 1: Cumulative facility totals, in billions

Source: Federal Reserve

| Facility | Total | Percent of total |

| Term Auction Facility | $3,818.41 | 12.89% |

| Central Bank Liquidity Swaps | 10,057.4(1.96) | 33.96 |

| Single Tranche Open Market Operation | 855 | 2.89 |

| Terms Securities Lending Facility and Term Options Program | 2,005.7 | 6.77 |

| Bear Stearns Bridge Loan | 12.9 | 0.04 |

| Maiden Lane I | 28.82(12.98) | 0.10 |

| Primary Dealer Credit Facility | 8,950.99 | 30.22 |

| Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility | 217.45 | 0.73 |

| Commercial Paper Funding Facility | 737.07 | 2.49 |

| Term Asset-Backed Securities Loan Facility | 71.09(.794) | 0.24 |

| Agency Mortgage-Backed Security Purchase Program | 1,850.14(849.26) | 6.25 |

| AIG Revolving Credit Facility | 140.316 | 0.47 |

| AIG Securities Borrowing Facility | 802.316 | 2.71 |

| Maiden Lane II | 19.5(9.33) | 0.07 |

| Maiden Lane III | 24.3(18.15) | 0.08 |

| AIA/ ALICO | 25 | 0.08 |

| Totals | $29,616.4 | 100.0% |

Source: “$29,000,000,000,000: A Detailed Look at the Fed’s Bail-out by Funding Facility and Recipient” by James Felkerson, forthcoming, Levy Economics Institute, based on data analysis conducted with Nicola Matthews for the Ford Foundation project “A Research And Policy Dialogue Project On Improving Governance Of The Government Safety Net In Financial Crisis”.

‘Goldman Sachs Dictatorship - Hitler’s Dream’

Time is running out for Eurozone leaders to save the single currency, as they prepare for eleventh-hour talks in Brussels. Germany and France are pushing to change EU treaties, to create a fiscal union and introduce tougher budget rules.However, the European Council President believes they can achieve the same goals without altering existing treaties, which would need a lengthy ratification process.

The British Prime Minister warned he wouldn’t agree to anything which damaged the UK’s role in the European market. Meanwhile, credit ratings giant Standard and Poor’s has added to the sense of urgency, as it threatens to downgrade 15 Eurozone countries as well as their bailout fund. Investigative journalist Tony Gosling says countries need to return to their own currencies if they’re to escape being ruled by Brussels.

sending...

sending...