A video about globalization and Nike sweatshops all over the world

Bank of America 2012: The Worst Is Yet To Come?

By: Dan Freed

Bank of America may have had a dismal 2011, but you haven’t seen nothing yet.

The thinking on Bank of America has long been that valuations are so low, the stock can’t get any lower — and then lower it goes. The problem, by and large, has been mortgage risk. Bank of America can’t ever seem to get a handle on how much exposure it has. The number just keeps growing and growing.

But that won’t be the problem in 2012. As the famous saying goes, you don’t know who isn’t wearing swimming trunks until the tide goes out. In this case, however, we do know: it’s Bank of America. And things have been so bad for the bank — not only in 2011 but ever since the crisis — that we tend to forget that the tide hasn’t even gone out yet. We’ve had a serious crisis in Europe, massive political instability in the Middle East and Russia, and a recession in the U.S. and the S&P 500 is only down 2.53 percent.

Some may see this as a sign of the market’s resilience, but that would be a mistake. Investors are still counting on the European crisis resolving itself. They are betting that European governments believe they have too much to lose by not eventually creating euro bonds.

But as Financial Times managing editor Gillian Tett explained on Charlie Rose last week, look how hard it was for former Treasury Secretary Hank Paulson to get the “bazooka” he needed from Congress to restore investor confidence in U.S. markets.

“I mean if you get, have problems getting one person for a bazooka, try to think about 17 people for a bazooka [that will shoot] in a straight line.”

The 17 people, of course, are the 17 countries that use the euro. If you think getting the U.S. Congress to agree on anything is tough, you haven’t seen a thing.

What that means is that, even if we don’t see Greece move back to the drachma, leading to a military coup, as was postulated in The New York Times on Tuesday, we are likely to come far closer than we have so far. That means a sharp market selloff at the very least, by which I mean a 5 percent-plus drop in the S&P 500 in a single day and volatility reminiscent of what we saw in 2008. If you think that means good things for Bank of America stock, you are sadly mistaken.

Bank of America CEO Brian Moynihan tried to assuage investor concern over this issue in a speech to investors earlier this month.

“With the uncertainty around some of the economies in the world, what’s going [on] in Europe on a given day, what could happen in the U.S., we continue to position ourselves and make sure that we are in good shape to last through anything we see ahead,” he said.

Looking at the combined Bank of America Merrill Lynch balance sheets from the third quarter of 2008, Moynihan said loans were at $1 trillion, and are 17 percent lower today. The loans are of better quality, he says, funding is less short-term than it used to be, he says.

And yet, you still have analysts like Deutsche Bank’s Matt O’Connor predicting the bank will have to issue $15 billion worth of stock next year.

It doesn’t take a Bank of America-related disaster to send the stock lower. Wednesday’s action was a good indicator of this fact, as Bank of Americas shares were down 1.69% about 75 minutes before the close as Europe-related tumult continued to roil the stock market. Shares of JPMorgan Chase and Wells Fargo, meanwhile, were in positive territory.

Will Bank of America survive the coming market disaster?

Probably, but let’s get real, folks: this is not a canoe you want to be sitting in when the storm comes across the Atlantic.

Source: https://www.cnbc.com/id/45673978

US In Iraq: Soldiers Out; Blackwater In?

By rt.com

“The biggest thing in my mind is ‘Will the press, will members of Congress and others continue to say it’s just a name change?” Tim Wright asks CNN. “Will they accept this as real change now?’”

Probably not. After all, it is hard for most people to shrug off the massacre of droves of innocent civilians.

Wright has recently come on board as CEO of Academi, a new name that the former execs at Blackwater have applied to the security squad in hopes of rebranding their organization after a decade of bad press and poor results. The controversial military contract company has raised eyebrows since the US government first installed its men and women overseas to reinforce America’s military presence, which instead resulted in a series of brutal killings of civilians gone largely without reprimand. In 2009, they changed the name from Blackwater to Xe Services LLC, and with their latest announcement, are rebranding once again in order to save face.

Easier said than done.

“Our focus is on training and security services. We’re continuing that,” CEO Wright tells Wired.com’s Danger Room.“We’re not backing away from security services. The lion’s share of our business today is providing training for security services and [providing] security services.” Such security patrol has been the bulk of Blackwater (under whichever guise it chooses to go by that month) since the start of the company in 1997, but has come as a challenge for the security forces.

“As we make changes and they take root and we convince everyone they’re real,” Wright adds to Danger Room, “then the real proof in the pudding is convincing the government of Iraq and the U.S. government to let us do business in Iraq.”

With President Obama formally discussing the withdrawal of American troops the same afternoon as Wright reveals the name-change, that business might be easier said than done. After a decade of a war that a reporter asked Obama today if he thought it was “dumb,” Iraq is surely to be hesitant in allowing security forces back into the country, even with a cute name change. As per Obama’s promise, American troops will empty out of Iraq by the month’s end. Will Academi pick up the slack?

“We have had a year of extraordinary changes that have resulted in a new, better company,” Write says in an official statement on the company’s website. Among those changes are bringing Patriot Act purveyor and former-US Attorney General John Ashcroft on board at Academi. The result, says Wright, will allow for Academi to “develop a culture of operational excellence, governance, accountability and strategic growth.”

Even if they contractors aren’t allowed back in Iraq, they will still have a presence on America’s other long-standing battlefield; currently, Academi has a 10-acre operating base in Kabul, Afghanistan.

The Real Victims of Jon Corzine & MF Global’s Bankruptcy

By Jeff Macke

If you’re obsessed with headlines from Europe, fixated the Federal Reserve’s final policy meeting of 2011, and generally ready to tune out for the rest of the year, that’s just the way Jon Corzine wants it.

The embattled former Senator, Governor, head of Goldman Sachs (GS), and CEO of MF Global will testify again today, this time in front of his pals and former peers in the U.S. Senate. Presumably Corzine will be sternly grilled regarding how MF Global came lose $1.2 billion in client funds. Cynics and those who saw Corzine’s first Congressional testimony last week would logically expect the disgraced ex-Senator to dole out blame to others while congratulating himself for not taking the Fifth.

The gist of Corzine’s defense is that he simply couldn’t understand where the money went. It’s been a performance somewhere between a drug-addled teen trying to track down his keys and Michael Corleone’s testimony in The Godfather II. Corzine totally doesn’t know where the money is and if anyone working for MF Global did anything untoward the titular leader of the firm at the time had no way of knowing about it.

An eviscerating article in Sunday’s NY Times called into question just how hands-off Mr. Corzine was. Citing inside sources, the Times says “Mr. Corzine compulsively traded for the firm on his Blackberry during meetings, sometimes dashing out to check on the markets.”

A presumption of innocence aside, Corzine’s having been an actively trading CEO yet claiming ignorance as to the clearing and processing activities of his firm falls somewhere between implausible and the lie of a financial sociopath.

Former a market strategist for MF Global Rich Ilczyszyn (rhymes with “magician”) has firsthand experience with the firm and the impact its bankruptcy has had. Now the founder of iitrader.com, Ilczyszyn doesn’t claim to know how Mr. Corzine’s legal battle is going to turnout, but he’s willing to hazard a guess as to the reaction of his former co-workers regarding Corzine’s claim regarding the missing $1.2billion.

“I think I can speak for a lot of clients from MF and investors that used the firm, ‘you’ve got to be kidding me!’” he says.

Ilczyszyn clearly has moved on personally and professionally from MF, as have many of those employed by the firm on the trading floors. It’s the other 3,000 or so former MF employees for whom Ilczyszyn reserves his concern.

There are jobs “in this industry if you’re specifically in futures or commodities, but outside my heart goes out to all the back-office support,” he says. “All the people who helped the organization run on a daily basis; there’s a lot of folks I’m in contract with who are still seeking employment.”

Ilczyszyn is sincere in his concern, which means he outranks Corzine as a man if not in terms of their respective titles at MF Global.

The back office people are the real victims of MF Global’s collapse. They’re also the group who Corzine is putting on the hook for what is either his ineptitude or his malfeasance. When Corzine claims he never “intended” to mix client and firm funds or notes that he can’t retrace the numbers because he doesn’t have the paperwork, he’s blaming the everyday people working at a firm he lead into full-on liquidation.

Corzine’s rounds of testimony are the final insult on his way out the door from business leader to full-time defendant. The show starts at 10am; get ready to lose the remote and pass the popcorn.

International Bribery Scandal Invades The ECB

The bribery scandal came at the worst possible moment for the European Central Bank. Already it’s struggling on a daily basis with the ballooning debt crisis in the Eurozone. And it’s trying to defend its independence against an onslaught of demands to print unlimited amounts of euros and buy the crappy sovereign bonds of the Eurozone’s weaker members. But now, Ewald Nowotny, member of its Governing Council, is up to his neck in hot water.

A spokesperson of the state prosecutor in Vienna, Austria, announced on Monday that the criminal investigation of an international bribery scandal that has been simmering for a while has been expanded to over 20 suspects. And it has now entangled six current directors of the Austrian National Bank (OeNB), including its Governor, Ewald Nowotny (Handelsblatt).

The scandal is centered on a division of the OeNB, the Oesterreichische Banknoten- und Sicherheitsdruck GmbH, (OeBS), which is in the lucrative business of printing money, literally. And it has been active in soliciting bank-note business from foreign governments since 2000. On its website, it claims that it “excels at combining innovative security features with modern designs.” Apparently, it also excels at bribery, kickbacks, and money laundering.

According to the prosecution, OeBS paid €17 million in bribes to Syrian officials to obtain orders from the Syrian government (Wiener Zeitung). Payments were routed to offshore outfits, such as the Panamanian mailbox company Venkoy, with representatives in Switzerland. The prosecutor is further investigating €1.7 million in kickbacks that made their way back to Austria (Die Presse). Similar arrangements with Azerbaijan are also being investigated. Two weeks ago, four people—the managing director and the head of marketing of OeBS and two lawyers—were arrested. Bits and pieces of the affair began to see the light of the day last June, when questions were raised by Austrian tax authorities about the deductibility of these payments.

The OeNB confirmed on Monday that a criminal prosecution has been initiated against six of its directors, including its Governor Ewald Nowotny, Vice Governor Wolfgang Duchatczek, and Director Peter Zöllner, who were accused of having known about the bribery of foreign public officials in connection with the acquisition of bank note printing orders. Of course, it defended its directors: the accusations were based on statements by fired employees, it said—implying that it’s nothing but a vendetta. Based on the information the directors had in front of them at the time, they’d assumed that the payments were for actual and legitimate services, and that the acquisition of orders complied with all applicable rules and laws, it said.

But on November 9, the Vienna-based daily paper Kurier created a stir when it said that it had obtained a copy of the minutes of the OeNB Board of Directors meetings. According to these minutes, the directors had known for years that millions of euros in bribes were being paid to acquire bank-note business from foreign governments.

For example, on March 24, 2010, the managing director of OeBS informed the OeNB board about a possible order from Azerbaijan for 150 million bank notes that carried a “commission” of 10%. And how did the board react? “Duchatczek asked the managing director to initiate the acquisition activities so that the years 2011 and 2012 would be at capacity.”

Over the years, the minutes show, Nowotny, Duchatczek, and their colleagues asked questions about various payments but then did nothing. For example, on December 15, 2008, Nowotny asked about the amount of a commission and the recipient in Azerbaijan. The managing director then “informed that there is a representative in Switzerland,” and that the commission would amount to 20% of the order. And that was that.

The OeNB had already tried to stamp out the brushfire and protect its directors by firing the managing director and the director of marketing at the OeBS. Stated reason? An internal audit revealed “unlawful actions and withholding of information from the Supervisory Board.” At the time, the bribery of Syrian officials had already surfaced, along with €600,000 in “unusual expenses.”

Maximum penalty for bribery is ten years in prison, according to the Handelsblatt. But given the impunity with which central bankers act, I doubt that Nowotny or the other central bankers will ever face any serious risk of ending up there. He might not even lose his jobs at the OeNB and at the ECB. And his future, well, given that he is a central banker, looks bright.

Proton Bank in Greece had siphoned off $1 billion in a scheme of fraud, embezzlement, money laundering, and offshore front companies. And got bailed out. But then a bomb exploded…. European Bailout Fund Pays For Greek Money Laundering And Fraud.

30 Major U.S. Corporations Paid More to Lobby Congress Than Income Taxes, 2008-2010

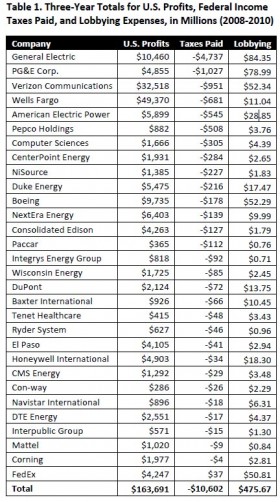

By employing a plethora of tax-dodging techniques, 30 multi-million dollar American corporations expended more money lobbying Congress than they paid in federal income taxes between 2008 and 2010, ultimately spending approximately $400,000 every day — including weekends — during that three-year period to lobby lawmakers and influence political elections, according to a new report from the non-partisan Public Campaign.

Despite a growing federal deficit and the widespread economic stability that has swept the U.S since 2008, the companies in question managed to accumulate profits of $164 billion between 2008 and 2010, while receiving combined tax rebates totaling almost $11 billion. Moreover, Public Campaign reports these companies spent about $476 million during the same period to lobby the U.S. Congress, as well as another $22 million on federal campaigns, while in some instances laying off employees and increasing executive compensation.

29 Major Corporations Paid No Federal Taxes, 2008-2010

Of the 30 companies analyzed in the report, which include corporate giants such as General Electric, Verizon Communications, Wells Fargo (WFC), Mattel (MAT) and Boeing (BA), 29 of them managed to pay no federal taxes from 2008 to 2010. Only FedEx, which raked in about $4.2 billion in profits during that period, paid a three-year tax rate of 1 percent — totaling $37 million — far less than the statutory federal corporate tax rate of 35 percent.

The Public Campaign report expanded on a newly released analysis on corporate tax dodging by the liberal-leaning Citizens for Tax Justice, a non-profit research and advocacy group, as well as lobbying expenditure data provided by the non-partisan Center for Responsive Politics.

Citizens for Tax Justice, the sister organization to the Institute on Taxation and Economic Policy, reports that 68 of the 265 most consistently profitable Fortune 500 companies did not pay a state corporate income tax during at least one year between 2008 and 2010, while 20 of them paid no taxes at all during that period.

“Our report shows these corporations raked in a combined $1.33 trillion in profits in the last three years, and far too many have managed to shelter half or more of their profits from state taxes,” Matthew Gardner, Executive Director at the Institute on Taxation and Economic Policy and the report’s co-author, said in a statement. “They’re so busy avoiding taxes, it’s no wonder they’re not creating any new jobs.”

According to the report, titled “Corporate Tax Dodging in the Fifty States, 2008-2010,” state corporate tax revenues have been declining for 20 years, due to the passage of multiple state tax subsidies, as well federal tax breaks that further reduce state corporate income tax revenues since states usually accept corporations’ federal tax. Moreover, Gardner said multi-state corporations are constantly “devoting their money and legal firepower to coming up with tax avoidance schemes.”

Between 2008 and 2010, the 265 companies analyzed paid state income taxes equal to only 3 percent of their U.S. profits, half of the statutory 6.2 percent state corporate tax rate. As a result, these companies avoided a total of $42.7 billion in state corporate taxes over three years.

“As recently as 1986, state corporate income taxes equaled 0.5 percent of nationwide Gross State Product (a measure of nationwide economic activity),” states the report. “But in fiscal year 2010, state and local corporate income taxes were just 0.28 percent of nationwide GSP, equaling the low-water mark set in 2002.”

Companies’ Laying Off Workers While Receiving Tax Rebates, Raising Executive Pay

Among the 20 companies who paid zero or less in state corporate taxes are utility provider Pepco Holdings, the pharmaceutical company Baxter International, and Intel Corporation (INTC).

Baxter International (BAX) and Intel are among the corporations that Public Campaign reports did not did not pay federal incomes during the same three-year period.

Of those companies, General Electric (GE) spent the most on lobbying, expending about $84 million on lobbying while paying a federal income tax rate of negative 45 percent on more than $10 billion in U.S. profits. PG&E Corp. followed General Electric, spending almost $79 million on lobbying, while paying a negative 21 percent tax rate on $4.8 billion of U.S profits, and Verizon Communications, which spent $52 billion on lobbying while paying a negative 3 percent tax rate on $32.5 billion of profits.

A negative effective tax rate means that a company enjoyed a tax rebate, usually obtained by carrying back excess tax deductions and credits to an earlier year, thereby allowing the company to receive a tax rebate check, according to Citizens for Tax Justice.

U.S. House Deputy Whip Kevin Brady, R-Tex., is currently making a last-ditch effort to include a corporate tax repatriation holiday on legislation to extend a payroll tax cut, an extension that Senate Majority Leader Harry Reid, D-Nev., said could put an extra $1,500 into the pockets of middle class families each year. While those in favor of the corporate tax repatriation provision — which would give U.S. businesses a temporary tax break on as much as $1 trillion in overseas income — insist it would boost the nation’s sluggish economy and make it easier for corporations to create jobs, the Congressional Budget Office reports tax repatriation holidays ranks dead last among 13 policy options for creating jobs. The CBO estimates that over the 2012-2013 period, a repatriation holiday would, at best, create the equivalent of one-full time job for every $1 million in federal costs.

Even while dodging most of their state and federal taxes between 2008 and 2010, Verizon (VZ) laid off more than 21,000 U.S. employees, while Boeing, Wells Fargo, General Electric, American Electric Power, and FedEx also let go of thousands of workers. Because companies can be reluctant to make data changes in U.S. employment available, Public Campaign reports it was not able to find up-to-date employment statistics for many of the companies evaluated in the report.

Moreover, as it was laying off employees, General Electric gave their top executives a 27 percent pay raise between 2008 and 2010 — executives received more than $75 million in compensation in 2010. Wells Fargo increased executive pay by a whopping 180 percent, upping executive compensation from $17.8 million in 2008 to almost $50 million in 2010, while Boeing, FedEx and American Electric Power also instituted lavish executive pay raises while laying off thousands of lower-level workers.

In fact, 2010 year was a record year for executive compensation. The CEO’s of some of the largest U.S. corporations made, on average, $11.4 million in 2010, about 343 times more than workers’ median pay, according to an analysis by the American Federation of Labor, the widest gap between executive and employee pay in the world. CEO pay has skyrocketed since 1980, when chief executives were only paid about 42 times more than the average blue collar worker.

Meanwhile, the U.S. Census Bureau reports that the median household income fell $3,719 between 2000 and 2010, when measured in 2010 dollars.

Public Campaign released its report on Wednesday, just as thousands of unemployed Americans from across the nation swarmed K Street in Washington, D.C., the lobbying center for some of the world’s most profitable corporations. The march was part of “Take Back the Capitol,” a four-day series of events aimed at persuading Congress to pass comprehensive job creation measures that will benefit their constituents, rather than special interest groups.

Source: https://www.ibtimes.com/articles/264481/20111209/30-major-u-s-corporations-paid-lobby.htm

Cancer Costs Forecast To Rise 62% By 2021

The cost of diagnosing and treating cancer patients could rise by two-thirds over the next decade, according to a new report.

Healthcare analysts Laing and Buisson warned diagnosis and treatment costs are set to increase by 62% from £9.4bn in 2010 to £15.3bn by 2021.

This will mean the average cost of treating someone suffering from cancer will go from £30,000 in 2010 to almost £40,000 in 2021.

The Cancer Diagnosis and Treatment: A 2021 Projection report, conducted for Bupa, warns this will inevitably affect cancer survival rates in the UK.

It said: “If we do not address the rising cost of cancer, we are unlikely to be able to afford the desired and expected level of cancer diagnosis and treatment over the next 10 years and beyond.

“This possibility will mean that the UK’s cancer survival rate could fall even further behind that of other developed countries.”

The study comes weeks after data from the Organisation for Economic Co-Operation and Development revealed the UK is lagging behind other countries on average survival rates for breast, bowel and cervical cancer.

The predicted hike in costs would largely be due to Britain’s ageing population, which is predicted to lead to a 20% growth in cancer rates by 2021.

Rising costs of technology and treatments used to combat forms of the disease will also be a contributing factor.

Professor Karol Sikora, medical director of Cancer Partners UK , said: “Ironically, the reasons behind this dramatic increase in costs are a cause for celebration.

“Cancer is predominantly a disease of older people and because of the advances of modern medicine, many more are living in good health well beyond retirement. This trend is set to continue so cancer incidence will inevitably rise.

“Fortunately, when cancer does strike, we now have powerful new technologies available to gradually turn cancer into a chronic, controllable disease like diabetes.

“However, the rising numbers and the advent of innovation come with a hefty price tag.”

According to the report, the NHS will take the greatest hit, with the money it spends on diagnosing and treating cancer going up by £5.2bn.

Costs are also predicted to rise in the private sector by an estimated £531m and by £131m in the voluntary sector.

Source: https://uk.news.yahoo.com/cancer-costs-forecast-rise-62-2021-005343944.html

sending...

sending...