As explained in the article Learning Careerism As A Moral Reward System; our society, specifically our education system teaches and prepared us for a careerist lifestyle. Or simply put, working for money is considered success in our societies.

But not only does it teach us to work for currency. Just as we are put down in school for having poor grades, in society we are put down and even ridiculed, almost as criminals, for having low paid jobs, and even more so for having no paid job at all.

This video shows how people are eager to help someone until people assume they are homeless, and that the homeless are also more eager to help people in need:

We live in a society where those with the most important jobs to our survival work long hours, often  physically tiring and are not paid very much. There are only a few kinds of workers that we really need, farmers/food producers, construction/manufacturers, delivery, maintenance/repair, and public services such as hospital workers and good police.

physically tiring and are not paid very much. There are only a few kinds of workers that we really need, farmers/food producers, construction/manufacturers, delivery, maintenance/repair, and public services such as hospital workers and good police.

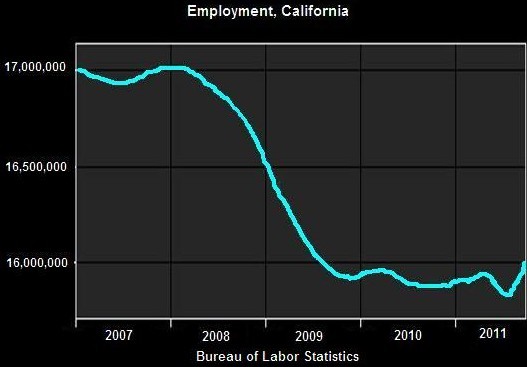

As time goes on there is more automation, so there are less jobs available but more people and so more food, building, maintenance, healthcare, and so on is required. However farmers are being paid less as time goes on, many selling their farms to get a different job, as their valuable work doesn’t even pay the bills. Construction workers, store workers, repair services and delivery are often paid low or minimum wage. Construction or farm work is much physically harder than sitting in an office trading stocks, yet those people are praised because they make more money.

There are often stories of fire-fighters and medical workers on strike because they are on a low wage or have poor quality working conditions, but these are the true heroes of our society, these people save us from death. Farmers, medical workers and fire-fighters should be the highest rewarded and praised workers of society, not some of the least.

We should also give more credit to those who are building and maintaining places for us to live comfortably in.

It is shameful that the harder a job is, the less money the workers will make, and those who make the most money in society actually have the easier jobs and often work the least.

In our society even these workers that we require for survival are not made a priority, money is. We are taught that if we work hard we can get a good job, and a good job pays well, most people still believe this and look up to those with ‘well-paid’ jobs and look down on those with a low paid job or those who are considered poor.

The truth is that in almost all cases the LESS-ethical the persons job, the more money they will earn. We could consider the most ethical of all work to be charity work, helping those with less, yet most of this work is either volunteer work or paid minimum wage. Those without jobs at all are looked down on, even when they volunteer to do charity work. Looked down on by those who mess around with numbers to make bigger numbers (trading stocks and shares), or managers; people who make sure that other people work so that they can take a larger cut.

Our parents tried to teach us good ethics and morals, but then they told us to obey at school, which taught us that these twisted careerist ideologies were moral and ethical.

Those without any paid employment, often also without any debt are sometimes homeless, and our society also tells us that they are homeless because they are drug addicts or alcoholics, and therefore we should not help them, even though many of these people are not drug-addicts or alcoholics, and if they are, it is often a sickness that is created by the world they live in, they simply didn’t have enough money or got kicked out by an ex-partner. Relationship breakdown and illness can happen to anyone.

So we have those who work very unethical jobs making ridiculously high amounts of money, those looked down on for having low paid work, even though it is physically more productive, those who are ridiculed for not having a ‘paid’ job or claiming some kind of state benefit, and then the homeless who cannot even apply for many kinds of state benefits or most jobs because they cannot complete the forms without a valid address, and often an email address or phone number; sometimes even the phone number must be a landline number, and of course to apply for a job most of the time these days a printed Résumé/CV is required.

Amnesty international reported that approximately 3.5 million people in the U.S. are homeless, many of them veterans. It is worth noting that, at the same time, there are 18.5 million vacant homes in the country.

AP also reports that nearly 1 in 2 Americans have fallen into poverty.

CBS News reports that “According to a new report out this past week, poverty in America has reached its highest level since 1965″.

So as a whole this brings up a question, apart from a few specific careers, is paid work ethical? How many ethical jobs do you know that are helping people to survive or live comfortably and are not profiting some corporation, or share holders, sat back, relaxing, watching the money you make entering their bank accounts.

When we do get paid, a high percentage of that money gets cut to go to government as income tax, however we give them another chunk of money from VAT, another tax, then depending on where you live there are multiple other taxes such as state tax, council tax, road tax, import tax, property tax, inheritance tax, and so on…

sending...

sending...