By: CNBC.com

Fitch Ratings downgraded its credit ratings on five major European commercial banks and banking groups Wednesday as part of a broader review of its ratings on the largest banks in the world.

In a press release, the rating firm said it downgraded Banque Federative du Credit Mutuel, Credit Agricole, Danske Bank, OP Pohjola Group and Rabobank Group.

The firm said the downgrades reflect the “broader phenomenon of stronger headwinds facing the banking industry as a whole. Exposure to troubled euro zone countries through their subsidiaries was a direct consideration in the downgrades of Danske Bank and Credit Agricole.”

For the other banks, Fitch said the crisis had “negative indirect consequences.”

Capital markets, “in particular interbank markets, are not functioning effectively, and, along with more global factors, the crisis is driving economic slowdown,” according to Fitch.

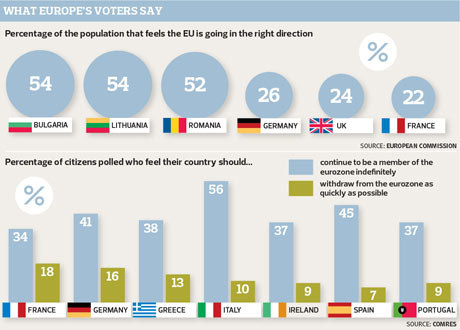

During his leadership campaign in 2005 he attracted sceptic support by promising to pull the Tories out of the pro-integration alliance of centre-right parties, the European Peoples’ Party (EPP). He infuriated Merkel and Sarkozy when he did so and formed a rival anti-integration group with a hotch-potch of eastern European parties with nationalist, homophobic and anti-semitic connections and no influence in the EU.

During his leadership campaign in 2005 he attracted sceptic support by promising to pull the Tories out of the pro-integration alliance of centre-right parties, the European Peoples’ Party (EPP). He infuriated Merkel and Sarkozy when he did so and formed a rival anti-integration group with a hotch-potch of eastern European parties with nationalist, homophobic and anti-semitic connections and no influence in the EU.

sending...

sending...