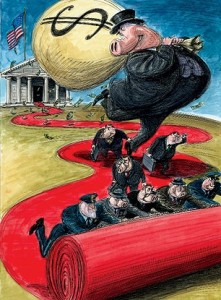

Every military strategist and war time general knows never to attack an empire head on. You destroy it from the inside out. You cut off supply lines (sanctions), cause civil unrest or civil war by funding both sides (Sunni and Shiite in Iraq), and instill economic destruction and slavery with usery (interest on top of interest to make freedom from debt impossible).

This financial situation we are in is no accident. How can it be? With the supposed best and the brightest Harvard and Yale educated minds making life changing decisions on our behalf, how can they be wrong so often? How can they be so ignorant or naive as not to learn from the past? How can the state of our country and many others around the world be an “accident”? The answer of course is, it can’t be.

If you overspend and have problems paying your bills during a particular month and one of those bills goes into collections, do you do the same thing next month? No, you make sure you don’t repeat that same mistake. Guess what? There is a really good chance you never even went to Harvard or Yale, and you figured that out all by yourself. Imagine that?

Obama’s brilliant answer to this problem was to put the very bankers that caused this situation in charge of the banking industry and to impose (I’m trying not to laugh as I type this) “unprecedented regulatory reform” over Wall Street.

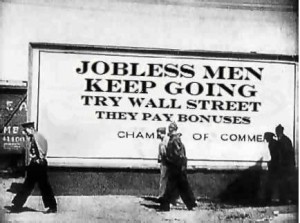

Roosevelt did almost the exact same thing after Hoover left office as to “ensure nothing like this would ever happen again”. But yet here we are “again” albeit with one great difference. That difference is the peoples’ ability to be self sufficient. In the late 20′s and 30′s, people had the ability to farm, to manufacture useful items with their hands, to barter. Their dollars were backed in gold. That was until 1934 when the government ordered all citizens to surrender their gold in the name of “stabilizing markets“. Coincidentally, gold spiked $15 per oz. after the confiscation. Nice profit, too bad it wasn’t in the hands of the people. Most people posses none of those skills, so what will they do?

I understand that its hard to accept the idea of our current situation as being one of intent, but it’s time we do. The sooner we come to this realization, and accept it, the easier it will be to deal with what’s coming.

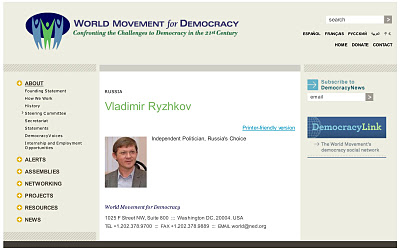

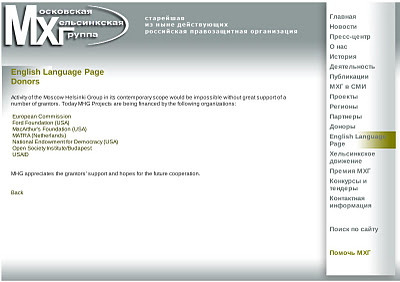

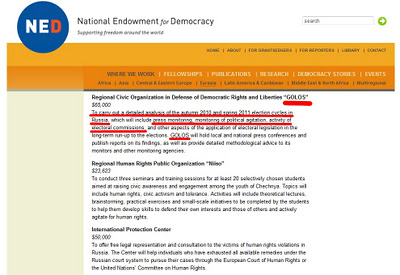

Photo: Wall Street and London’s media machine claims Russia’s protests are “leaderless” and not being organized by political opposition movements - even as it interviews protest organizers such as the above pictured opposition leader, Boris Nemtsov, who takes to stages build amidst supposedly “spontaneous” protests with a troupe of US NED-funded NGO leaders and opposition parties cheerleading what is clearly yet another Western-funded color revolution.

Photo: Wall Street and London’s media machine claims Russia’s protests are “leaderless” and not being organized by political opposition movements - even as it interviews protest organizers such as the above pictured opposition leader, Boris Nemtsov, who takes to stages build amidst supposedly “spontaneous” protests with a troupe of US NED-funded NGO leaders and opposition parties cheerleading what is clearly yet another Western-funded color revolution.

sending...

sending...